Energy and Infrastructure

J&F Group Takes Charge of Brazil’s Nuclear Future with Eletronuclear Acquisition

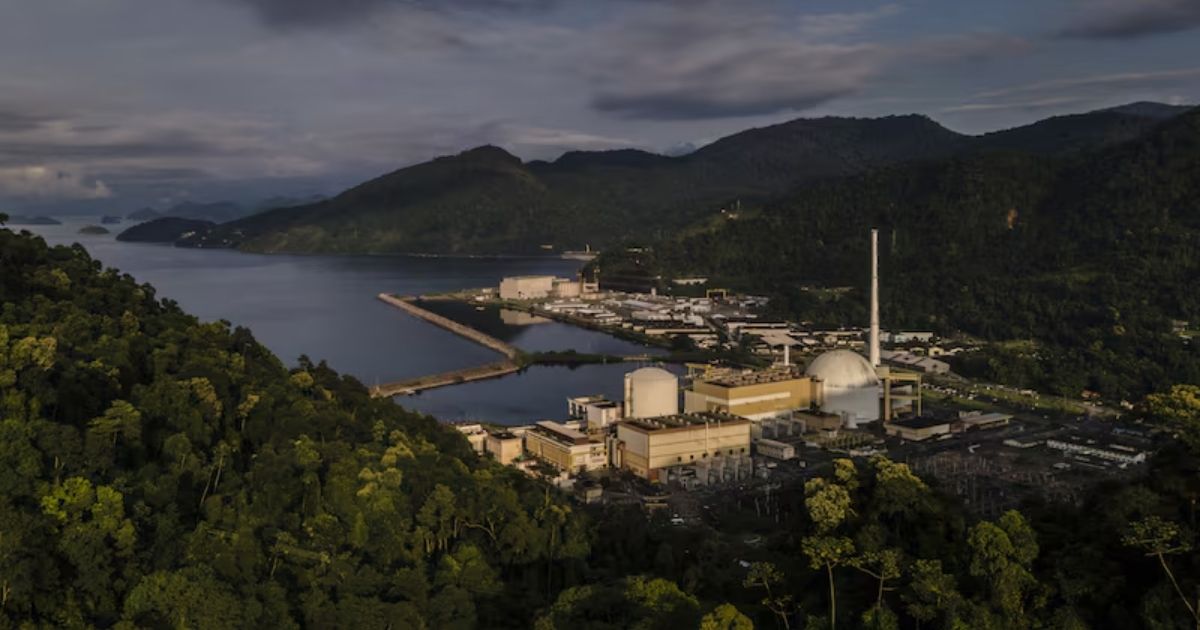

Eletrobras sells 68% of Eletronuclear’s capital (35.3% voting) to J&F’s Âmbar Energia for BRL 535 million, marking the conglomerate’s first move into nuclear energy.

The Deal – J&F Investimentos Eletronuclear Acquisition

J&F Investimentos Eletronuclear acquisition marks one of Brazil’s most strategic energy transactions of 2025. On 15 October 2025, Eletrobras signed a contract to sell its stake in Eletronuclear for BRL 535 million (approximately USD 98 million) to Âmbar Energia, a subsidiary of the J&F Investimentos Group. Under the terms, Âmbar will hold 68 percent of Eletronuclear’s total capital and 35.3 percent of its voting capital post-closing. Government control remains via ENBPar. The Eletrobras sale also includes the assumption by the buyer of obligations and guarantee transfers relating to BRL 2.4 billion in debenture guarantees.

Strategic Context of the J&F Investimentos Deal

This transaction forms part of Eletrobras’s post-privatization restructuring. The utility continues to divest non-core assets—including its nuclear exposure—as it repositions toward transmission and renewables. For J&F, the Âmbar Energia Eletronuclear acquisition represents a bold expansion into one of Brazil’s most heavily regulated sectors. The conglomerate adds nuclear generation to a portfolio already spanning energy, agribusiness, and infrastructure.

Who Is J&F Investimentos and Why This Eletronuclear Deal Matters

The acquiring group is controlled by Brazil-based investment holding J&F Investimentos, founded in 1953. J&F controls the world’s largest meat- and animal-protein producer, JBS S.A., a global leader in beef, pork, and poultry production and export. Through JBS and its subsidiaries, the group operates production plants across Brazil, the United States, and more than 20 countries. It describes itself as “the largest private business group in Brazil,” with activities in food, energy, pulp & paper, mining, financial services, and industrial sectors. Its scale—particularly through JBS’s global footprint—has made J&F a dominant exporter of animal protein. This financial capacity positions the group to lead complex infrastructure operations such as the J&F Investimentos Eletronuclear acquisition.

The Firms Behind the Deal

TozziniFreire Advogados represented J&F Investimentos Group in Brazil.

The team was led by partner Carlos Mello and counsel Fabiana Pasmanik, supported by the firm’s Tax, Regulatory, and Capital Markets departments—an experienced TozziniFreire Eletronuclear bench for regulated M&A.

Tauil & Chequer Advogados in association with Mayer Brown acted as U.S. legal counsel to J&F Group, with partner Bruno Salzano leading the firm’s deal team.

Notable team also supporting the deal included Elio Wolff, Rafael Gusmão, Leonardo Walter, Gabriel Magalhães Chimelli, Marina Thury Lopes, and Luciana M. Petrucio.

The seller’s counsel has not been publicly disclosed. BTG Pactual acted as financial advisor to Eletrobras.

Why the J&F Investimentos Eletronuclear Acquisition Matters for Brazil’s Energy Market

The deal underscores the growing interplay between private and state capital in strategic energy assets. It required coordination between TozziniFreire Advogados and Tauil & Chequer Mayer Brown, balancing regulatory obligations and cross-border structuring. This J&F Investimentos deal illustrates how Brazilian conglomerates are reshaping public-infrastructure ownership with support from sophisticated local and international counsel.

Key Issues and Risk Points in the Eletronuclear Sale

Regulatory and governance: nuclear-sector oversight and ENBPar’s retained control create a hybrid public-private model.

Liabilities and guarantees: Âmbar assumes about BRL 2.4 billion in guarantees linked to Eletronuclear’s debt.

Valuation and risk: sale price below book value reflects legacy and regulatory uncertainties.

Political and reputational: state partnership and public scrutiny demand exceptional compliance standards.

Outlook / Next Steps for the J&F Investimentos Deal

The Âmbar Energia Eletronuclear acquisition awaits approval from Brazil’s nuclear authority and CADE. Once cleared, J&F / Âmbar will manage integration and financing obligations tied to Eletronuclear’s plants, including the Angra 3 reactor.

Conclusion – Private Capital in Brazil’s Nuclear Transition

The J&F Investimentos Eletronuclear acquisition signals that Brazil’s strategic energy sectors are cautiously opening to private capital. With J&F’s entry, the line between public and private energy ownership blurs further—and TozziniFreire Advogados and Tauil & Chequer play a central role in structuring this new regulatory frontier.

Related Reading

- J&F Investimentos enter nuclear business in Brazil

- Brazil Eletrobras sells Brazil Electronuclear to J&F Group

- Volaris Group Expands in Brazil with Acquisition of Useall

Resumo em português

A Âmbar Energia, do grupo J&F Investimentos, comprou 68% do capital da Eletronuclear (35,3% votante) da Eletrobras por BRL 535 milhões. O negócio marca a entrada do grupo no setor nuclear brasileiro, com assessoria jurídica da TozziniFreire (Carlos Mello, Fabiana Pasmanik e as equipes tributária, regulatória e de mercado de capitais) e da Tauil & Chequer (Bruno Salzano, Elio Wolff, Rafael Gusmão, Leonardo Walter, Gabriel Magalhães Chimelli, Marina Thury Lopes e Luciana M. Petrucio) nos Estados Unidos.

Resumen en español

Âmbar Energia, del grupo J&F Investimentos, adquirió el 68% del capital de Eletronuclear (35,3% con derecho a voto) a Eletrobras por BRL 535 millones. La transacción marca la entrada del grupo en el sector nuclear brasileño, con TozziniFreire (Carlos Mello, Fabiana Pasmanik y los equipos tributario, regulatorio y de mercado de capitales) y Tauil & Chequer (Bruno Salzano, Elio Wolff, Rafael Gusmão, Leonardo Walter, Gabriel Magalhães Chimelli, Marina Thury Lopes y Luciana M. Petrucio) como asesores legales.