#Latinamerica

Zuckerberg Invests in Beep Saude Alongside Banco Bradesco

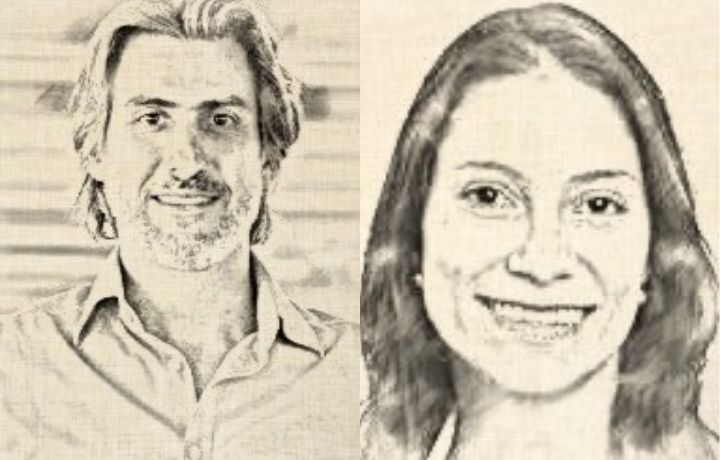

TozziniFreire partners João Busin and Juliana Maluf represented Mark Zuckerberg’s CZI and the investors

CZI, a fund of Mark Zuckerberg, founder of the Meta Group, and his wife Priscila Chan, was the investment vehicle used for the deal

Mark Zuckerberg invests in Beep Saude, a Brazilian health tech, in a Series C round co-led by Banco Bradesco’s investment fund. Original investors Valor Capital, David Velez, CEO of Nubank, and DNA Capital also participated in the round.

It is the company’s second investment round in just over a year. In April 2021 the startup received a series B investment in the amount of BRL $110 million led by Valor Capital Group.

Although the company claims that Series C was an up round valuation, the startup did not disclose the value of the transaction, which made analysts skeptical as to whether the transaction was in fact a down round, specially looking from Mark Zuckerberg’s eyes as he has seen his darling Facebook holdings heading south by almost 73% this year.

Together with engineers Iuri Menescal and Rodrigo Ferrer, CEO Vander Corteze, a medical doctor, launched Beep Saúde in 2016 with a home vaccination program, a solution now available in more than 150 cities across the states of Rio de Janeiro, São Paulo, Espírito Santo, Paraná, Pernambuco and the Federal District in Brazil.

Beep Saúde was inspired in Amazon’s business model, and operates with the purpose of being 100% e-commerce based. With a lean overhead and high technology logistics deployed, which allows arrival to patients’ homes using an efficient roadmap, the startup bets it will beat the traditional lab competitors.

“What Beep can do is offer a better service than that of a premium laboratory, according to our own customers, at the cost of an entry laboratory,’ says Cortese, enthusiastically as Zuckerberg invests in his Beep Saúde.

What’s next as Mark Zuckerberg invests in Beep Saúde

With the downturn in the venture capital market, the startup had to review its plans. Instead of entering new states, the company chose to maintain the operation in the six current states it services and seek to increase the number of lives by its program. The forecast is to double in two years, reaching 10 million lives serviced.

The Esquires and the Firms Behind the Deal

TozziniFreire Advogados acted as Brazilian legal counsel to CZI and the investors with a team led by partners João Busin and Juliana Soares Zaindan Maluf with contribution from associates Luis Felipe Sima and Pedro Biancardini.

The IFRL1000 and Legal 500 accredited partner João Busin is head of the Private Equity & Venture Capital practice group of TozziniFreire and together with Juliana Maluf are based in the São Paulo headquarters of the firm, and are regarded as renowned specialists in the M&A Venture Capital and emerging growth technology companies spaces.

The Latin America Chambers 2023 and Legal 500 TozziniFreire is a full service law firm and one of the most traditional firms of Brazil with headquarters in São Paulo and offices in Rio de Janeiro, Brasilia, Campinas, Porto Alegre, Caxias do Sul and New York.

Cooley LLP acted as U.S. counsel to CZI and the investors.

Partner Daniel Parames and associate Alexandre Turqueto (picture) led the firm’s deal team.

Cooley LLP is a full service US Global law firm with headquarters in Palo Alto, California, and with 16 offices around the world.

Bronstein, Zilberberg, Chueiri & Potenza Advogados represented and acted as Brazilian legal counsel to Beep Saúde.

Partners Sergio Bronstein and Eduardo Zilberberg led the Bronstein Zilberberg deal team which included associates Fabio Baum, Giuliana Primati, Giovana Suslik and Amanda Iranaga.

The 2022 Chambers Brazil and Legal 500 Bronstein Zilberberg is a full service law firm based in São Paulo and is highly recognized as one of the top M&A Venture Capital law firms in the country.

-

#Brazil2 anos ago

#Brazil2 anos agoJe Suis Ukraine

-

#Brazil3 anos ago

#Brazil3 anos agoBrazil Credit Fintech TerraMagna Raised $40 Million Led by Softbank in Its First Entry into Farming

-

#Latinamerica3 anos ago

#Latinamerica3 anos agoLatin America Stands Out in November Venture Capital and Acquisition Activities

-

#Latinamerica3 anos ago

#Latinamerica3 anos agoHow Fundable is Your Startup

-

#Brazil3 anos ago

#Brazil3 anos agoAgrolend Raises $14 Million All-Equity Series A Led by Valor Capital

-

#Brazil3 anos ago

#Brazil3 anos agoMattos Filho Advised Underwriters in Nubank’s IPO

-

#Brazil2 anos ago

#Brazil2 anos agoGoldman Sachs Invests in Unico IdTech and Takes the Brazilian SaaS Startup Valuation above $2,5 Billion

-

#Brazil2 anos ago

#Brazil2 anos agoBrazil’s Grão Direto Lands Series-A2 from Agribusiness Powerhouses Cargill, Louis Dreyfus Company, Archer Daniels Midland Company and Amaggi Agro.

-

#Brazil2 anos ago

#Brazil2 anos agoBrazil’s Medway Lands Series-A Round of $15 Million Led by Softbank Latin American Fund

-

#Brazil2 anos ago

#Brazil2 anos agoDigital Private Pension Broker Saks Lands BRL 26 Million Seed Investment from Itaú-Unibanco’s Private Equity Fund Kinea and Canary

-

#Brazil2 anos ago

#Brazil2 anos agoCarbonext Receives $40 Million from Shell for Carbon Credit Projects in Brazil’s Amazon

-

#Brazil2 anos ago

#Brazil2 anos agoBrazilian Fintech Marvin Lands Series-A of $15 Million Backed by American Early Venture Capital Canaan