#Brazil

Mattos Filho Advised Underwriters in Nubank’s IPO

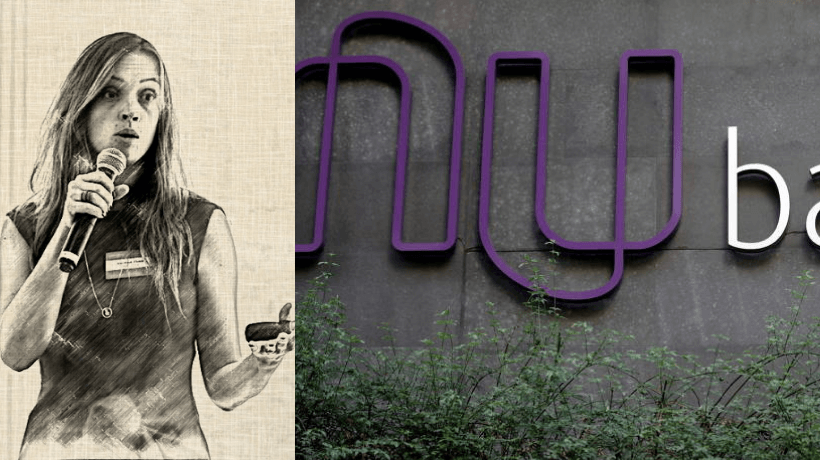

Partner Vanessa Fiusa led the Mattos Filho’s capital markets team

Mattos Filho, Veiga Filho, Marrey Jr e Quiroga Advogados assisted the underwriters in the IPO of Nubank

Mattos Filho advised the underwriters on the IPO of NuBank where class A common shares of the company were listed on the New York Stock Exchange and as BDRs (Brazilian Depositary Receipts) at São Paulo’s B3 S.A.

Nubank’s arrived on the exchange via its holding company, Nu Holdings Ltd. (NYSE: NU) based in the Cayman Islands, which consolidates all segments and countries in which the digital bank operates.

Mattos Filho, Veiga Filho, Marrey Jr e Quiroga Advogados represented the underwriters Nu Invest Corretora de Valores S.A, Banco Morgan Stanley S.A., Goldman Sachs do Brasil Banco Múltiplo S.A., Citigroup Global Markets Brasil, Corretora de Câmbio, Títulos e Valores Mobiliários S.A, Banco HSBC S.A., UBS Brasil Corretora de CTVM S.A., Banco Safra S.A.,

Partner Vanessa Fiusa (pictured) led the Mattos Filho’s capital markets team with associates Henrique Ferreira Antunes, Gabriela Castro Rabelo, Yasmin Karam Tomaino, Vivian Hatushikano, Matheus Salim Tavares, in this pioneer offering in both Exchanges.

She is is one of the firm’s top capital market stars with extensive practice in Brazil and practice in the United States.

Mattos Filho enlisted its top guns to handle this iconic simultaneous IPO.

Mattos Filho, Veiga Filho, Marrey Jr e Quiroga Advogados assisted the underwriters in the IPO of Nubank. The Firm is a full service law firm with headquarters in São Paulo, and offices in Rio de Janeiro, Brasilia, Campinas, New York and London.

White & Case, LLP acted as U. S. counsel to the same parties.

Pinheiro Neto Advogados acted as Brazilian legal counsel to Nu Holdings S.A.

Pinheiro Neto Advogados acted as Brazilian counsel to the issuer and other companies within its economic group and relied on partners Henrique Lang, Guilherme Sampaio Monteiro, senior associates Tatiana Guazzelli, Raphael Palmieri Salomão, Luiz Felipe Fleury Vaz Guimarães, associates Julia Barbosa Campos, Lucas Cassoli Bretones, legal assistants Gabriela Kaneshiro Pereira and Vinicius Gonzaga.

The firm is one the most traditional full service law firms in Brazil. Pinheiro Neto is headquartered in São Paulo with offices in Rio de Janeiro, Brasilia, Palo Alto and Tokyo.

Davis Polk & Wardwell LLP (U.S. counsel to the issuer). Campbells Corporate Services Limited (Cayman Island counsel to the issuer).

Davis Polk & Wardwell LLP. acted as U.S. counsel to Nu Holdings S.A.

Nubank’s IPO was the first to simultaneously register a stock offering abroad with the SEC and with the CVM (Brazil’s Regulator Body) through a Brazilian Depositary Receipts offering in Brazil.

The Global Offering reached BRL $14,452,161,324.47, not considering the amount allocated to the Customer Program and the over-allotment option, placing Nubank as the leader in the volume offered among IPOs in Brazil, and positioned the company as the most valuable bank in Latin America.

Although Nubank had an impressive week in its debut in the New York Stock Exchange, the company’s shares have come down more than 20% from last week’s peak, as the market is looking into some Brazilian fintechs debacle such as Stone loosing more than 80% of its highs and PagSeguro suffering a 53% haircut from its peak.

The markets’ concerns about Latin American fintechs’ valuation and models have been pointed out in a recent article on this column in Nubank Slashes IPO Valuation Goal.

Today (15) the stock is holding a 16% loss from its high while the U.S. market is broadly negative.

-

#Brazil2 anos ago

#Brazil2 anos agoJe Suis Ukraine

-

#Brazil3 anos ago

#Brazil3 anos agoBrazil Credit Fintech TerraMagna Raised $40 Million Led by Softbank in Its First Entry into Farming

-

#Latinamerica3 anos ago

#Latinamerica3 anos agoLatin America Stands Out in November Venture Capital and Acquisition Activities

-

#Latinamerica3 anos ago

#Latinamerica3 anos agoHow Fundable is Your Startup

-

#Brazil3 anos ago

#Brazil3 anos agoAgrolend Raises $14 Million All-Equity Series A Led by Valor Capital

-

#Brazil2 anos ago

#Brazil2 anos agoGoldman Sachs Invests in Unico IdTech and Takes the Brazilian SaaS Startup Valuation above $2,5 Billion

-

#Brazil2 anos ago

#Brazil2 anos agoBrazil’s Grão Direto Lands Series-A2 from Agribusiness Powerhouses Cargill, Louis Dreyfus Company, Archer Daniels Midland Company and Amaggi Agro.

-

#Brazil2 anos ago

#Brazil2 anos agoBrazil’s Medway Lands Series-A Round of $15 Million Led by Softbank Latin American Fund

-

#Brazil2 anos ago

#Brazil2 anos agoDigital Private Pension Broker Saks Lands BRL 26 Million Seed Investment from Itaú-Unibanco’s Private Equity Fund Kinea and Canary

-

#Brazil2 anos ago

#Brazil2 anos agoCarbonext Receives $40 Million from Shell for Carbon Credit Projects in Brazil’s Amazon

-

#Brazil2 anos ago

#Brazil2 anos agoBrazilian Fintech Marvin Lands Series-A of $15 Million Backed by American Early Venture Capital Canaan

-

#Brazil2 anos ago

#Brazil2 anos agoHRTech Gupy Raises $93 Million Led by SoftBank and Riverwood