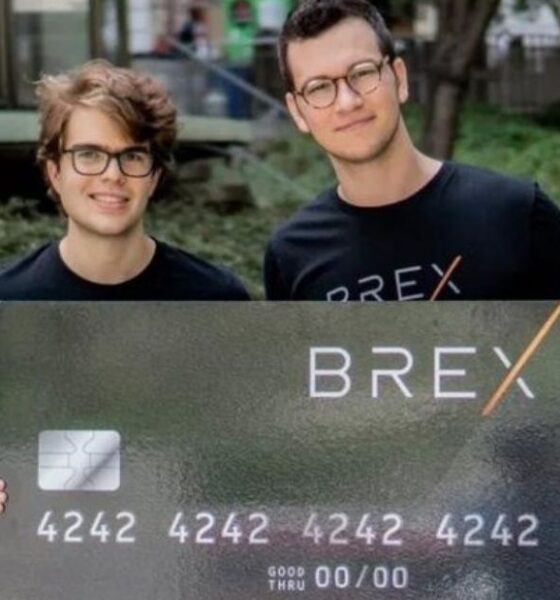

Brex Capital One acquisition marks one of the most significant fintech M&A transactions of early 2026, with U.S. banking group Capital One...

Brazil startup deals 2025 surged in October, driven by fintech, healthtech, and agtech rounds with major legal counsel support listed

A Brazilian education group moves into Spanish-speaking markets, betting on digital enrollment and regional scale.

A strategic move linking Asia’s fintech scale with Latin America’s SME-lending engine through embedded finance.

Vammo raises $45M to scale electric motorcycles and battery-swap hubs in Brazil.

Foley & Lardner and Demarest Advogados acted as legal counsel in Velotax Series A

Eletrobras sells 68% of Eletronuclear’s capital (35.3% voting) to J&F’s Âmbar Energia for BRL 535 million, marking the conglomerate’s first move into nuclear energy. The Deal...

Foley & Lardner advised Riverwood on AppZen’s $180M Series D, with Cooley representing the company in its latest global funding round

Enter raised $35M in Series A led by Founders Fund and Sequoia, valuing the Brazilian AI startup at R$2B.

Unico, valued at US$2.6B, acquired OwnID in a cross-border deal advised by Foley & Lardner LLP, led by partner André Thiollier.