#Brazil

Brazil’s Grendene Seals Joint Venture with 3G-Capital

Grendene of Gisele Bundchen’s Ipanema sandals teams up with João Paulo Lemann of 3G-Capital

[updated Nov 14, 2021]

Brazil’s Grendene S/A (B3:GRND3), the top competitor of Alpargatas S.A. (B3: ALPA3.SA) known worldwide for its flip-flops, closes a joint venture agreement with 3G Capital

Brazil’s Grendene S/A (B3:GRND3), the top competitor of Alpargatas S.A. (B3: ALPA3.SA) known worldwide for its flip-flops, closed a joint venture agreement with 3G-Capital of mega investors João Paulo Lemann, Alberto Sicupira and Marcel Telles, to distribute and market its products internationally. Shares jumped 8% on the news.

Grendene joint venture agreement with 3G-Capital has been structure so that the new venture will be controlled and managed by 3G Radar, which will hold 50.1% of the JV’s equity and appoint 3 members of its five-member board seats. Each party will contribute $50 million to Grendene Global Brands Limited based in the UK.

According to sources familiar to the deal, the agreement was sealed at the eleventh-hour on Friday, as a previous memo of understanding called for the closing of the deal in 90 days which expired on Oct. 15.

The Grendene joint venture agreement with 3G-Capital will bring to the company the opportunity to expand its worldwide distribution channel and brand recognition in hopes to catch up with Alpargata’s.

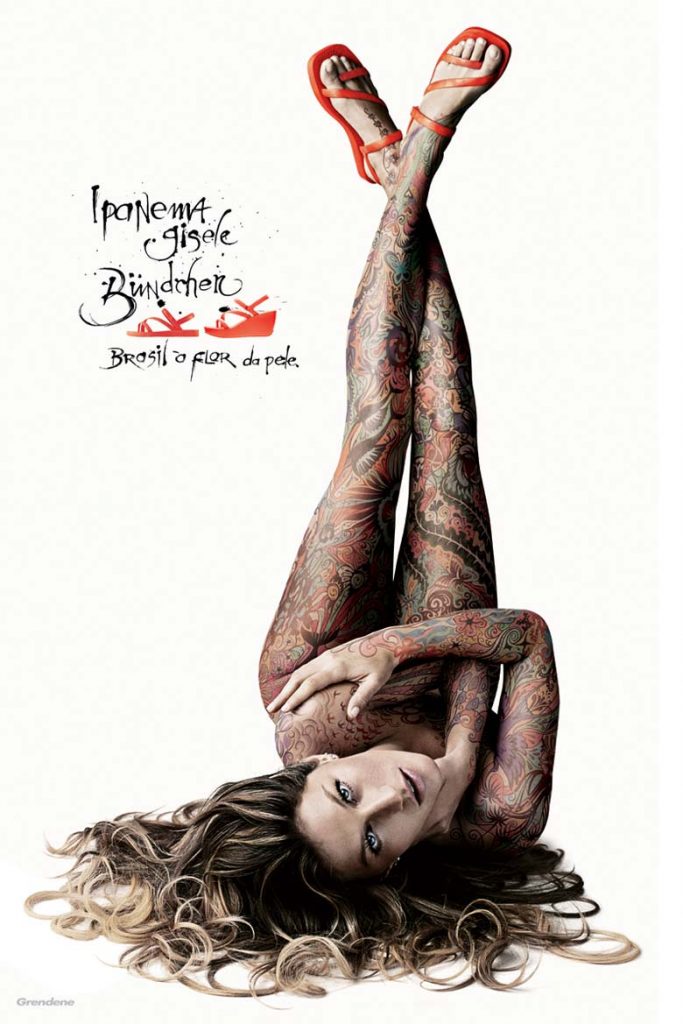

Grendene S/A’s brands became internationally known with the signing of world-star-supermodel, philanthropist and environmental activist Gisele Bundchen for the launch and follow-on campaign of its Ipanema flip-flop sandals.

The Esquires

A cross-border topnotch teams of law firms advised the deal.

Pinheiro Guimarães Advogados acted as legal counsel to Grendene S/A. The firm’s deal team was led by partners Marcelo Lamy Rego and Bernardo Bulhões-Arieira and associates Bernardo Romano Teixeira, Marcia Lamarão and Julia Machado Barreto (picture). Pinheiro Guimarães Advogados is a full service firm highly regarded in the specialties of banking, financing, M&A and Venture Capital.

BMA – Barbosa Müssnich Aragão, Linklaters and Herbert Smith Freehills also participated in the deal.

-

#Brazil2 anos ago

#Brazil2 anos agoJe Suis Ukraine

-

#Brazil3 anos ago

#Brazil3 anos agoBrazil Credit Fintech TerraMagna Raised $40 Million Led by Softbank in Its First Entry into Farming

-

#Latinamerica3 anos ago

#Latinamerica3 anos agoLatin America Stands Out in November Venture Capital and Acquisition Activities

-

#Latinamerica3 anos ago

#Latinamerica3 anos agoHow Fundable is Your Startup

-

#Brazil3 anos ago

#Brazil3 anos agoAgrolend Raises $14 Million All-Equity Series A Led by Valor Capital

-

#Brazil3 anos ago

#Brazil3 anos agoMattos Filho Advised Underwriters in Nubank’s IPO

-

#Brazil2 anos ago

#Brazil2 anos agoGoldman Sachs Invests in Unico IdTech and Takes the Brazilian SaaS Startup Valuation above $2,5 Billion

-

#Brazil2 anos ago

#Brazil2 anos agoBrazil’s Grão Direto Lands Series-A2 from Agribusiness Powerhouses Cargill, Louis Dreyfus Company, Archer Daniels Midland Company and Amaggi Agro.

-

#Brazil2 anos ago

#Brazil2 anos agoBrazil’s Medway Lands Series-A Round of $15 Million Led by Softbank Latin American Fund

-

#Brazil2 anos ago

#Brazil2 anos agoDigital Private Pension Broker Saks Lands BRL 26 Million Seed Investment from Itaú-Unibanco’s Private Equity Fund Kinea and Canary

-

#Brazil2 anos ago

#Brazil2 anos agoCarbonext Receives $40 Million from Shell for Carbon Credit Projects in Brazil’s Amazon

-

#Brazil2 anos ago

#Brazil2 anos agoBrazilian Fintech Marvin Lands Series-A of $15 Million Backed by American Early Venture Capital Canaan

Pingback: Pinheiro Guimarães Advised Brazil's Grendene in Joint Venture with 3G-Capital • Beyond the Law

Pingback: Brazil Fleury Acquires Hermes-Paradini• Beyond the Law